Data/Privacy breaches are the #1 cyber threat in automotive: Defend yourself and your family with Privacy4Cars

The Privacy4Cars Identity Theft Protection program is designed with current and past vehicle owners and renters in mind

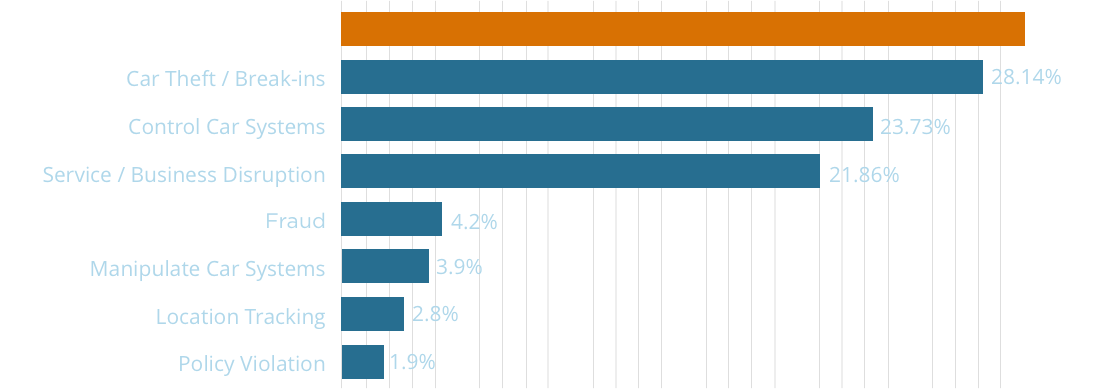

Impact Breakdown 2010-2020

– Upstream Automotive Cyber Threat Landscape 2021 report

In 2020 alone, Data/Privacy breaches were 36% of all automotive cyber incidents.

The Privacy4Cars Identity Theft Protection Program

Individual Policy

Enroll Now Through Our App

Fully Managed Identity Theft Recovery Service:

A dedicated toll-free # for victims to call the Our Victim Recovery Center 24/7/365 Bilingual (English and Spanish) Identity Theft Response Centers in Arizona and California to report becoming a victim and to open a recovery/restoration case.

Each victim is assigned a dedicated Identity Theft Recovery Advocate who will work the entire case until the victim is restored to pre-theft status.

The victim’s dedicated Advocate conducts an intake interview and develops a personalized case plan to document and dispute all fraudulent matters necessary to recover/restore the victim’s identity.

Through a Limited Power of Attorney, each victim’s dedicated Advocate will perform a Fully Managed Recovery/Restoration to dispute and reverse fraudulent transactions and accounts.

To help monitor continued resolution of each victim’s identity, victims receive one year of complimentary monitoring services that can include credit monitoring, name and alias monitoring, phone number monitoring, address monitoring, criminal monitoring, and internet black-market monitoring as needed.

Coverage includes all identity theft events discovered during the plan period, regardless of when the theft occurred.

Lost Wallet Service:

If a customer’s wallet or purse is lost or stolen, our call center professionals will help them identify their lost cards and documents and get them canceled and replaced as quickly as possible.

$25,000.00 Identity Theft Insurance*:

Reimburses for covered expenses from identity theft, including things like lost wages, postage and long distance costs, and covered legal fees.

Family Policy

Enroll Now Through Our App

Fully Managed Identity Theft Recovery Service:

The victim’s dedicated Advocate conducts an intake interview and develops a personalized case plan to document and dispute all fraudulent matters necessary to recover/restore the victim’s identity.

Through a Limited Power of Attorney, each victim’s dedicated Advocate will perform a Fully Managed Recovery/Restoration to dispute and reverse fraudulent transactions and accounts.

To help monitor continued resolution of each victim’s identity, victims receive one year of complimentary monitoring services that can include credit monitoring, name and alias monitoring, phone number monitoring, address monitoring, criminal monitoring, and internet black-market monitoring as needed.

Dark Web Monitoring & Surveillance:

We will alert you if we find that your personal information is available for thieves to use and we will work with you to implement actions that maximize your protection.

Lost Wallet Service:

If a customer’s wallet or purse is lost or stolen, our call center professionals will help them identify their lost cards and documents and get them canceled and replaced as quickly as possible.

$1,000,000.00 Identity Theft Insurance*:

Reimburses for covered expenses from identity theft, including things like lost wages, postage and long distance costs, and covered legal fees.

Disclaimer

* Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group, Inc., and sold through affiliations with licensed insurance brokers or agents. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Privacy4Cars, Inc. is not a registered insurance broker or agent.